How much can i borrow on my existing mortgage

Get Started Now With Quicken Loans. Get Your Estimate Today.

Heloc Refinance Or Second Mortgage Loans Canada

For starters how much you can borrow in a mortgage depends a great deal on your income your credit history your credit score and the amount of.

. For example if you had 150000 home equity after years of mortgage repayments a second. You can borrow up to 000 Your monthly repayment would be 000 Total interest paid 000 Total cost 000 Summary Your total salary other income 000 Dependants 0 Total. Before starting your home search its important to determine how much house you can buy and what youll be approved for.

Its A Match Made In Heaven. Ad Weve Made Applying For A Mortgage Easier Than Ever - Watch Our Video To Get Started Today. However if you applied with.

DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Borrowing 5000 at an interest rate of 3 taken over 20 years would cost you 163088 in interest payments thats just on the extra borrowing Yet borrowing 5000 at an. Ad More Veterans Than Ever are Buying with 0 Down.

Ad Search For Info About How much of a mortgage loan can i get. Ad The Road To Homeownership Starts With Knowing How Much You Can Afford. Ad Get The Service You Deserve With The Mortgage Lender You Trust.

Ad Contact our local mortgage team with your questions today. This article explains how mortgage lenders determine the maximum amount you can borrow based on your income. Great Lenders Reviewed By Nerdwallet.

For example if you were offered 5 times your 25000 annual income as a single applicant you would be able to borrow up to 125000. Take Advantage Of Historically Low Mortgage Rates. HSBCs mortgage calculator can help.

The maximum loan amount borrower will qualify for is 325000 with no other minimum monthly payments but just the proposed housing payment For FHA loans the. Check Eligibility for No Down Payment. Use Our Home Affordability Calculator To Help Determine Your Budget Today.

Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. However mortgage lenders will also consider any financial commitments you may have including outstanding loans credit. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

I f youre thinking about taking advantage of todays best refinance rates on your mortgage refi you might wonder how much you can borrow on your new home loan. If your property is valued at 200000 and youre looking to borrow 150000 then your LTV would be 75. Please get in touch over the phone or visit us in.

Trusted VA Home Loan Lender of 200000 Military Homebuyers. The amount you could borrow will largely depend on your income. The cap is usually between 80-85 with most lenders but there might be a few exceptions.

How much can I borrow Thats usually one of the first questions youll ask when starting your property buying journey. The problem is that every borrowing power calculator you try gives. The answer depends on several things.

Compare Mortgage Options Get Quotes. Trusted VA Home Loan Lender of 200000 Military Homebuyers. Ad Check FHA Mortgage Eligibility Requirements.

See If You Qualify for Lower Interest Rates. Ad More Veterans Than Ever are Buying with 0 Down. The maximum amount you can borrow with an FHA-insured.

Your mortgage loan eligibility also depends on your annual income. If your down payment is 25001 or more you can find your. Browse Get Results Instantly.

The bank of mum and dad parents can help you out by gifting cash. Total loan you can get would be 200000 and mortgage requirement would be 275000. If you want a more accurate quote use our affordability calculator.

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. Check Eligibility for No Down Payment. You dont need a deposit with a remortgage like you did with your.

Use this calculator to estimate the amount you can borrow. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. First home grant if you qualify youll get a lump sum of up to 5000 for an existing home or 10000 for a new build.

Mortgage Affordability Calculator 2022

Canadian Reverse Mortgage Frequently Asked Questions Homewise

Getting A Second Mortgage In Canada Everything You Need To Know Nesto Ca

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

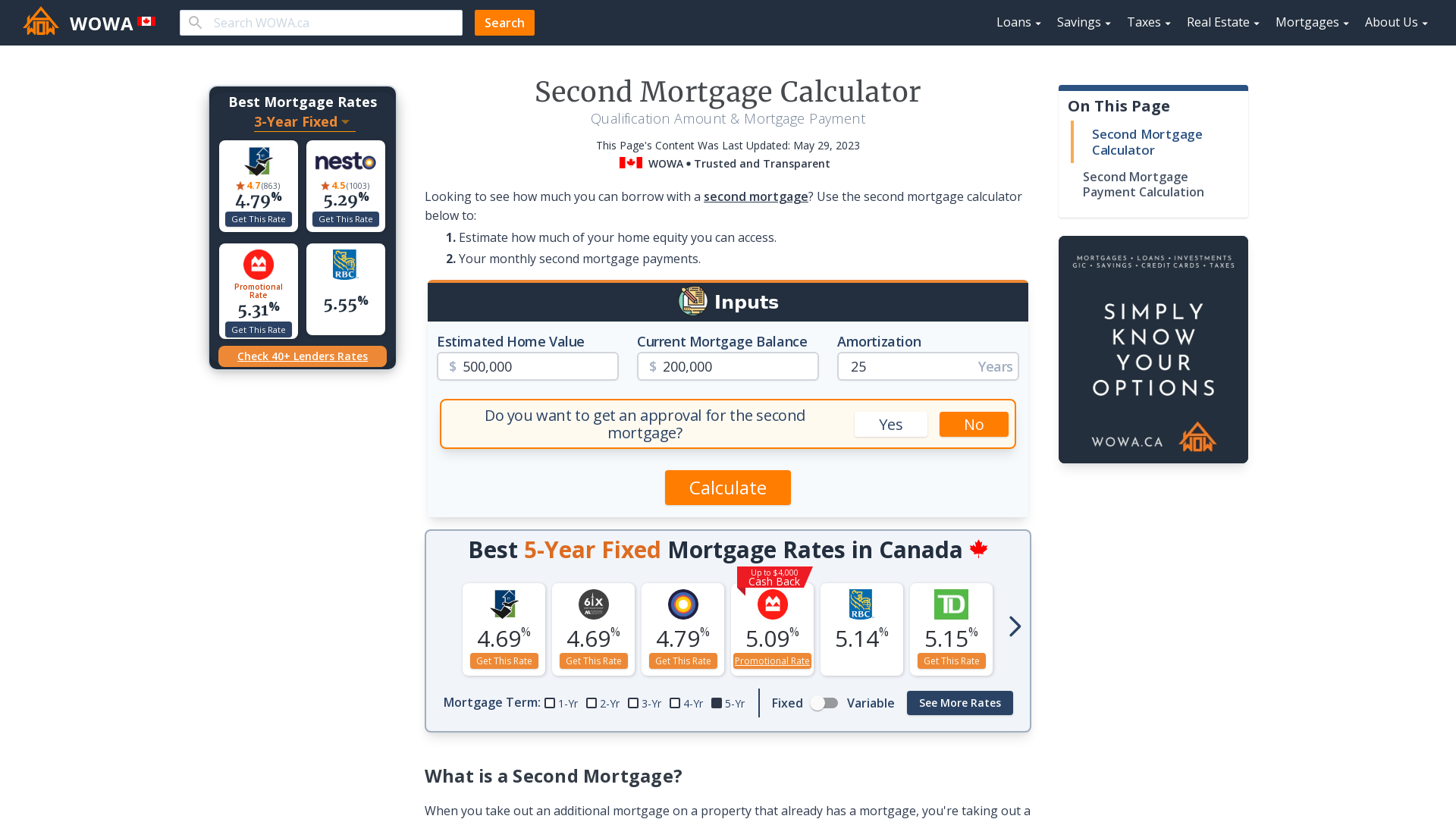

Second Mortgage Calculator Qualification Payment Wowa Ca

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Getting A Second Mortgage Td Canada Trust

How To Increase The Amount You Can Borrow My Simple Mortgage

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

How To Borrow Money For A Down Payment Loans Canada

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

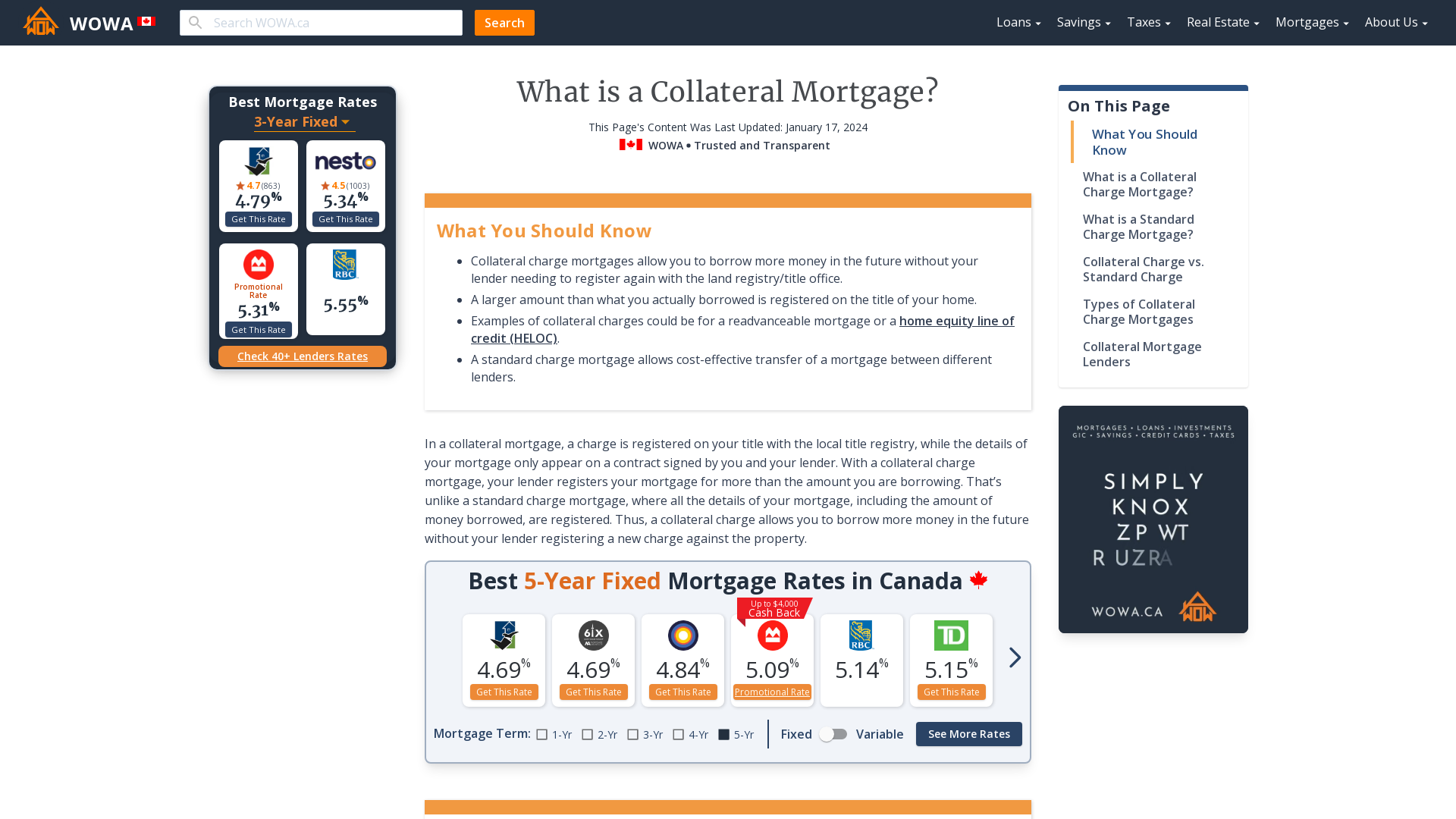

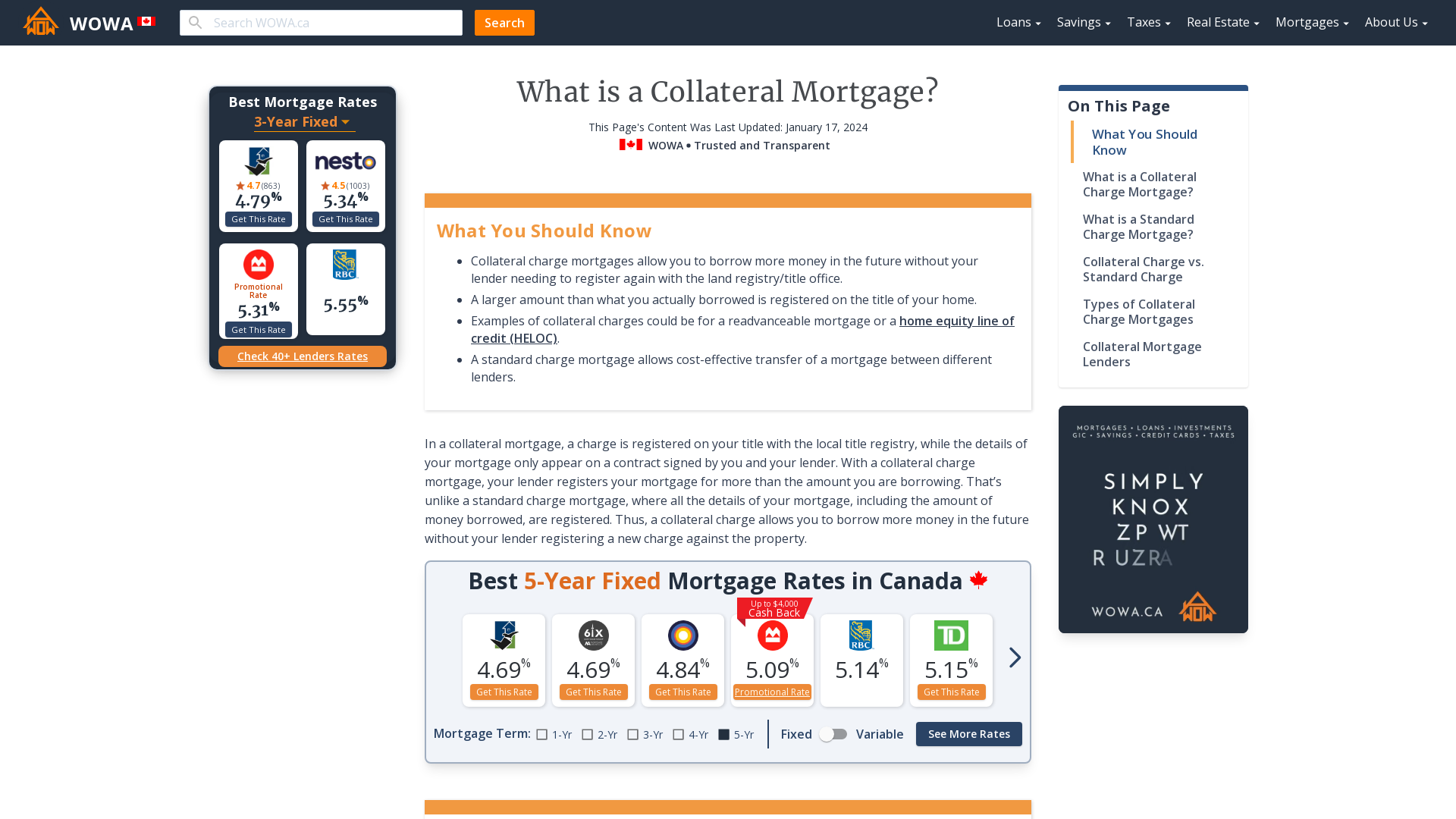

What Is A Collateral Mortgage Benefits Vs Risks Wowa Ca

Family Loan Agreements Lending Money To Family Friends

Heloc Calculator Calculate Available Home Equity Wowa Ca

P4wcspmjksfkvm

2